The athenahealth Marketplace Reality: Why Most Partners Stay Small (And What Changes That)

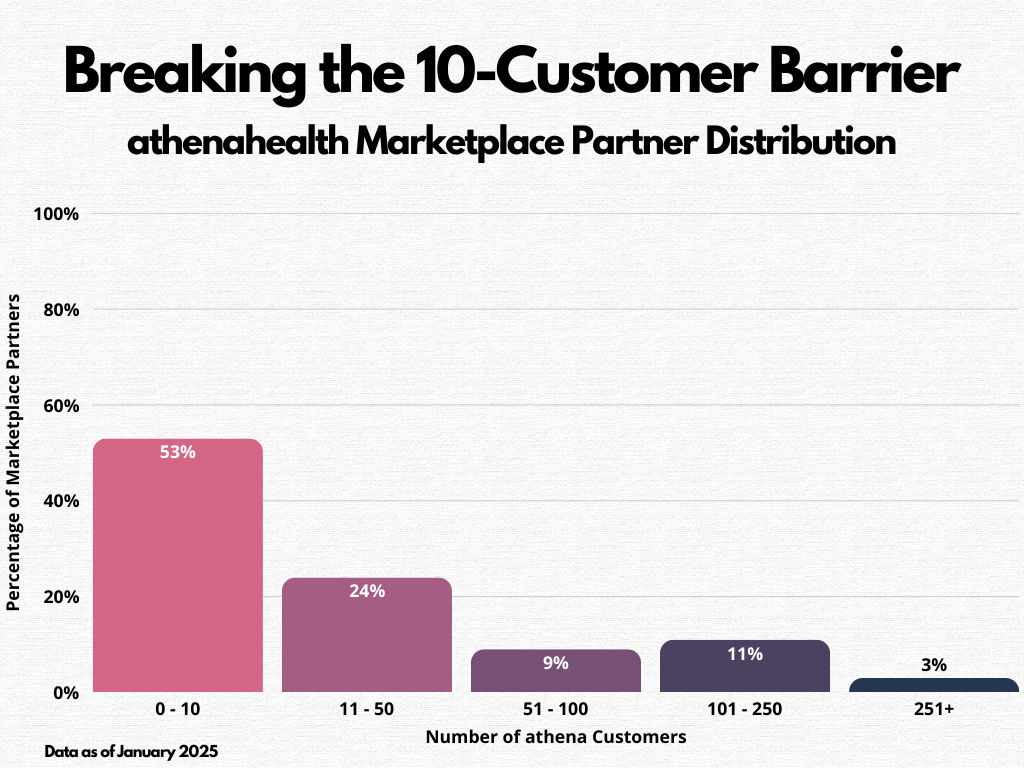

I've been analyzing athenahealth Marketplace data recently, and one finding stands out: 53% of marketplace partners have fewer than 10 customers.

That's worth unpacking, especially if you're considering the marketplace or wondering why your current listing isn't generating the results you expected.

Understanding the Marketplace Landscape

The distribution of marketplace partners tells an interesting story:

0-10 customers: 53%

11-50 customers: 24%

51-100 customers: 9%

101-250 customers: 11%

251+ customers: 3%

What we're seeing is a significant concentration at the early stage, with a notable drop-off as we move up the adoption curve. This isn't necessarily a failure, some partners may be new or intentionally niche. But for many, it represents unrealized potential.

The 10-Customer Threshold

Through my work with marketplace partners, I've observed that breaking past 10 customers often marks a shift from experimental adoption to sustainable growth. Partners who make this transition typically share several characteristics:

1. Clear problem-solution fit They address specific, measurable pain points for medical practices. Things like revenue cycle inefficiencies, patient communication challenges, or workflow bottlenecks. The value proposition is immediate and quantifiable.

2. Seamless integration experience Their solutions feel native to the athenahealth workflow. Practice staff can adopt the tool without significant training or workflow disruption. This isn't just about technical integration, it's about understanding how practices actually work.

3. Active market engagement These partners view the marketplace as one distribution channel among several. They invest in education, build relationships with practice consultants, and maintain visibility through multiple touchpoints.

4. Focus on retention and expansion Early customer success becomes the foundation for growth. These partners systematically collect feedback, iterate on their solutions, and turn satisfied customers into case studies and referrals.

Realistic Expectations for Marketplace Success

The marketplace offers genuine advantages: streamlined technical integration, built-in trust from the athenahealth association, and access to a large customer base. However, it's not a passive distribution channel.

Success requires:

A solution that delivers measurable value to practices

Investment in integration that goes beyond basic functionality

A go-to-market strategy that complements the marketplace presence

Resources dedicated to customer success and retention

Making an Informed Decision

If you're evaluating the marketplace opportunity, consider these questions:

Does your solution address a problem that athenahealth practices actively recognize and prioritize?

Do you have the technical resources to architect, build and maintain a robust integration?

Can you support a sales and marketing effort beyond the marketplace listing?

Are you prepared to invest in long-term customer success?

Moving Forward

The data shows that while many partners remain small, there's a clear path to growth for those who approach the marketplace strategically. The partners achieving scale aren't necessarily those with the most features or the biggest marketing budgets, they're the ones who understand their customers deeply and execute consistently.

If you're currently in the marketplace and looking to scale, or if you're considering joining, the key is to be realistic about what it takes while remaining optimistic about what's possible.

Let's Connect

I work with health tech companies navigating the athenahealth Marketplace, helping with technical integration architecture, go-to-market strategy, and delivery operations. If you'd like to discuss your marketplace strategy or share your experiences, I'd welcome the conversation.